BY combining cash with mobile technology, fintech is transforming lives, as well as disrupting the financial sectors’ big incumbents.

One such disruptor is Alex Kong, founder of the Hong Kong-based TNG Wallet, a fintech firm that was created in 2012 to provide banking and remittance services for Asia’s unbanked millions. This group constitute 70 percent to 80 percent of the population in developing countries, around 1.5 billion people.

Today TNG has more than 600,000 users in 13 countries and territories and is targeting expansion into new markets. It recently raised US$115 million in a Series A funding round led by Chinese private equity group NewMargin Capital.

TECH FIRMS SET TO GIVE BANKS A RUN FOR THEIR MONEY

Samantha Cheh | 21 November, 2017

At Web Summit, the annual tech conference held in Lisbon last week, Tech Wire Asia caught up with Kong to talk all things fintech.

Servicing the unbanked

Malaysian-born Kong was inspired to start TNG after he moved to Hong Kong ten years ago and couldn’t open a bank account because of his nationality. He realized millions of people have a similar problem.

In the last 18 months, Kong said TNG has grown more than 500 times because the demand from the unbanked population is so high.

“Every day for these non-banked users is an emergency; their family need money on a daily basis,” Kong said.

“They used to queue up every Sunday at Western Union for hours, fill out the same stupid form and pay the same high charges, but with us they can send money instantly, every day.”

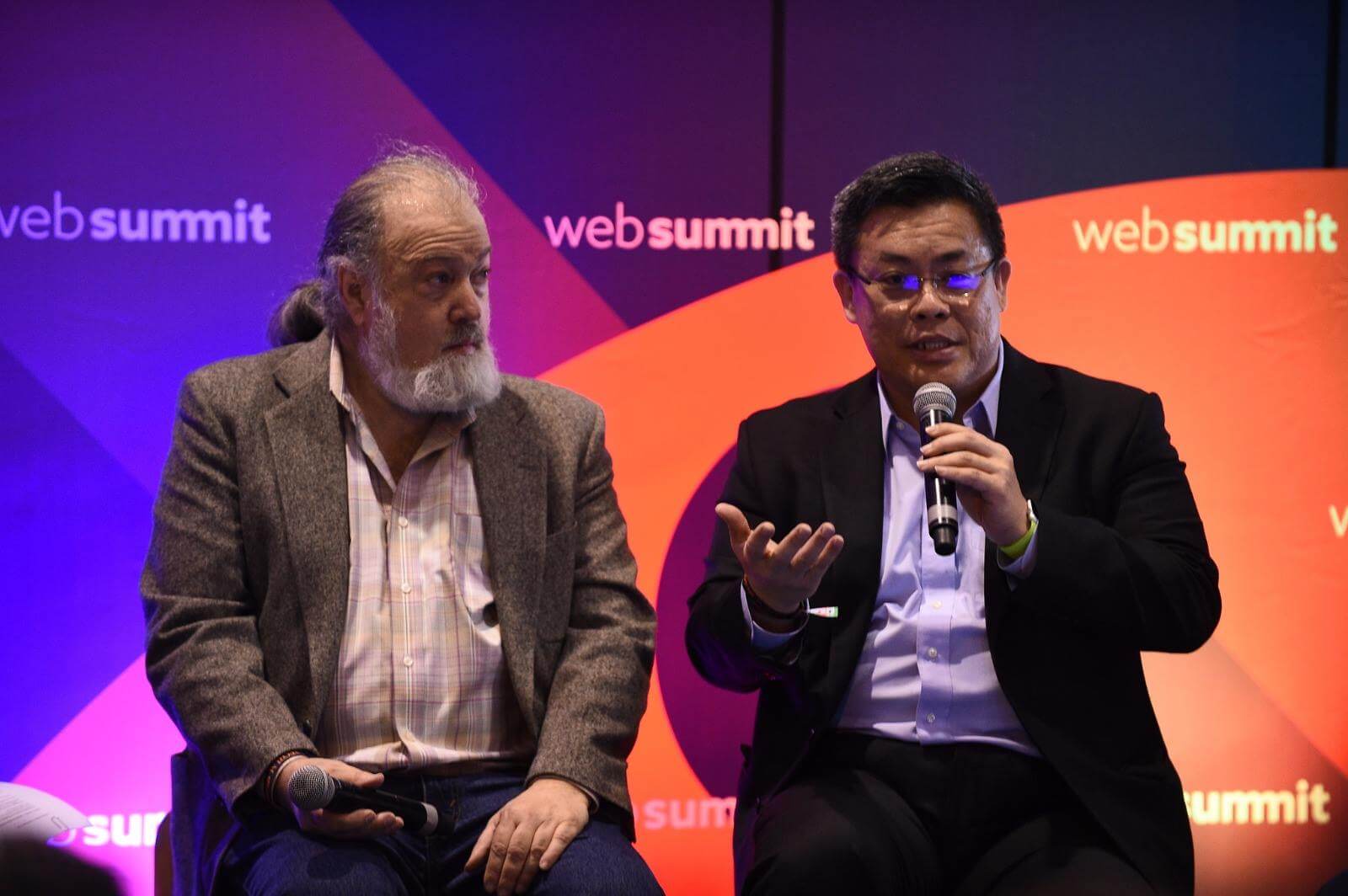

(From left) David Chaum and Kong speaking at Web Summit 2017. Source: Heidi Vella

On average TNG’s users are sending US$13 a day to loved ones in different countries. Money transfer to China from Hong Kong amounts to US$16 billion each year, says Kong, so his business has huge room for growth.

Along with remittance, TNG enables its users to pay in shops, withdraw money from post offices or convenience stores, as well as other services. Users don’t need to carry cash or cards. The company makes its money, Kong said, by charging for “financial services” and 1.25 percent to the retailer on shop purchases.

Eyeing expansion

Kong is poised for growth.

Three years ago the smart phone penetration in Myanmar was just three to five percent: now it is achieving 70 percent and in another two to three years it will be 100 percent, said Kong.

“You can buy a smartphone for US$35 and people may not have money to eat but they will pay for a smartphone,” he said.

PRUDENTIAL WANTS TO WORK WITH FINTECH STARTUPS TO TAKE INSURANCE DIGITAL

Samantha Cheh | 19 October, 2017

TNG is also eyeing expansion outside of Asia. The company will invest US$20 million to launch a local electronic wallet in the UK, Kong said, becoming the first Asian fintech company to access the European market.

Like other fintech companies, Kong said TNG has struggled with, but managed to overcome, problems with regulators.

“The regulators are learning quickly, we find them to be keeping a much more open mind than before,” he said. “They are now willing to sit down and listen and work with a company like us to manage the risk properly.”

Utilising cryptocurrencies

The company is also using controversial cryptocurrencies to reduce costs and save delays created by the central bank.

TNG is making use of cryptocurrency to reduce risks and delays. Source: Reuters

Every month TNG pays a billion dollars across the border, incurring fees when it is forced to transfer from local currency to dollars and back to local currency again.

The daily buying and selling of different currencies mean the company lost around 1.4 percent of the value of its money, said Kong.

Now it disintermediates US dollars by issuing its own cryptocurrency with multi wallets in different countries.

“In Hong Kong, we used to buy TLC, our cryptocurrency, transfer it from one wallet to pesos in the Philippines or Singapore dollars, for example. In Singapore we receive TLC, then one click and it can be converted back to Singapore dollars,” Kong said.

CASHCOW COIN FUELS COW FARMERS WITH ICO

Tech Wire Asia | 7 August, 2017

Companies making moves like this is rightly causing the central bank to become nervous.

“They are becoming less relevant and are facing a lot of pressure because we are already eating into their lunch – we are moving money at the speed of thought, whereas the traditional bank takes three to five days and charges a lot,” he adds.

Kong predicts the traditional bank will be a very different place three to five years from now, adding that this will benefit consumers.

And for the future of fintech? “Exciting, very exciting,” Kong said.